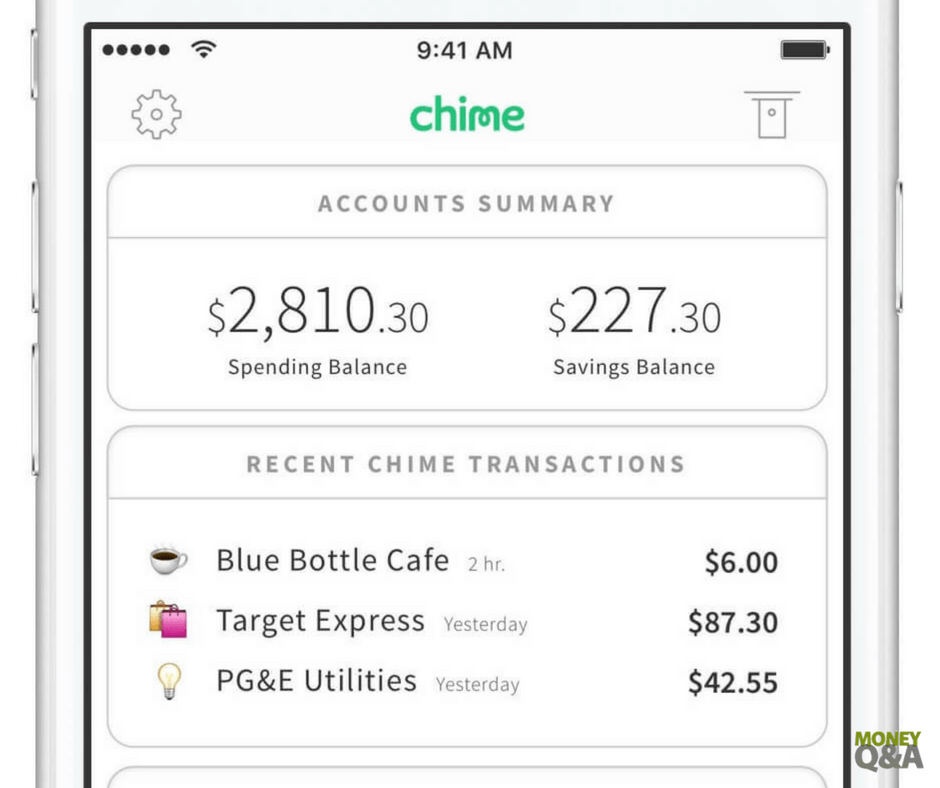

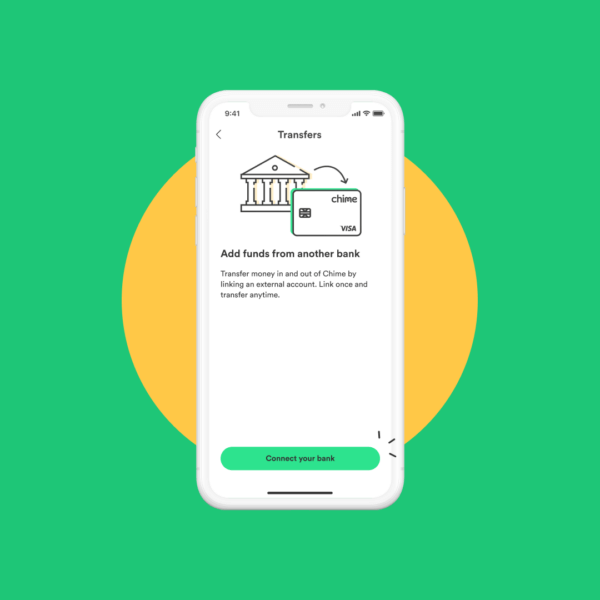

I can transfer money instantly, as many times as I want! This is by far my favorite banking experience. I get all deposits early and have never had any issues. I was the first person I know to get the stimulus checks! Chime is legit, the sh.;-D if you have direct deposit, you have the option to enroll in their 'SpotMe' program. You can deposit cash in your Chime Spending Account at over 90,000 retail locations (like Walmart, Walgreens, and 7-Eleven) with our cash deposit partners. Visit to find a cash deposit retail location near you. At the retail location, ask the cashier to make a deposit to your Chime Spending Account.

Money orders may not be the most innovative or technologically advanced payment method, but they can come in handy in many situations. An old school form of payment, money orders are a safer alternative to a regular check.

Chances are, you don’t use money orders all that often to pay for services or products; instead, you likely use cash, a credit card ordebit cardas your primary method of payment. But everyonce in a while, a scenario will come up in which you may need to use a money order, such as needing to send money internationally or deliver a payment without worrying about putting yourself in jeopardy offraudulent activity, or don’t want to risk a personal check bouncing.

Similar to paper checks, money orders are issued in the form of a paper document, and they are used when you want to pay for something. When you want to purchase a money order, you need to provide money upfront. And because of that, money orders ensure the receiver that they will get their payment. For example, if somebody gives you a money order worth $100, it’s as good as cash once you deposit it at your bank or take it to a financial institution to exchange it for money. In addition, instead of being backed by your personal bank account, like a check, a money order is backed up by an agency or large corporation. This makes it a more secure form of payment to the recipient.

When you purchase a money order, you pay the full amount upfront plus a small fee. After verifying that the amount is correct, you’ll need to fill in your name and contact information on the front of the money order, plus the name of the recipient and their contact information.

A memo line allows you to specify what the money order is for. You then sign the front as if it were a personal check. Be sure to keep your receipt in case you need proof of payment or want to track when the order is received.

Filling out a money order is pretty straightforward.

You’ll need to include the following basic information:

- Your name

- The name of the recipient

- Possibly your address and phone number. Pro tip: If you want to retain your privacy, ask if this information is necessary.

- There may be a memo area to fill in with notes

- You may need to sign it with your signature

Looking to cash a money order? Follow the steps below:

1. Find a location that cashes money orders

You can cash money orders at numerous locations. A few common places to cash a money order are banks, convenience stores, and credit unions.

2. Endorse your money order

Make sure you filled out your money order. Once you get to the location, sign the money order just like you would a check.

3. Show a valid ID

In order to verify that you are authorized to cash the money order, you will need to identify yourself so make sure to bring a government-issued ID like a driver’s license or passport.

4. Pay fees (if applicable)

If you’re cashing your money order at your bank, you might not have to pay fees. Otherwise, be prepared to pay a fee.

5. You’re done!

Get your cash and make sure you place it securely with you.

You may want to use a money order in the following scenarios:

- The receiver of the funds doesn’t want to run the risk of getting a bounced check.

- The person issuing the payment may need to cancel payment. For instance, if you believe the money order was stolen, you can pull the plug on issuing the funds.

- You want to protect your privacy. Money orders don’t include bank account information.

You may want to use a money order in lieu of cash for the following reasons:

- You want a receipt as proof of having made a payment

- If you’re worried about losing the cash (either misplacing it or having it stolen)

- If you have to pay an ATM fee to withdraw cash

Money orders come in handy for a number of reasons. You can use them for the following scenarios:

Paying for rent

There are many benefits to paying your rent with money orders. The first is a paper trail. You receive a receipt attached to the money order as proof you’ve paid your rent. And, if you lose the money order, you can file a claim to get your money back. Some places also allow you to track your orders online, so you can see when your landlord receives the money order. This way you’ll ensure the money gets in your landlord’s hands. Plus, you have proof you sent payment on time. Lastly, money orders are immediately withdrawn from your account so you can purchase a money order and rest easy that you won’t overspend and not be able to pay your rent.

FYI: If you’re having trouble staying on top of rent and bills, see how Chime’s Get Paid Early feature can help you get your paycheck faster

Buying from an online seller

If the recipient doesn’t know you and wants a secure form of payment, he may ask for a money order. Think of in-person transactions, such as buying something on an online marketplace like Facebook Marketplace or LetGo. In this scenario, you may meet up with the seller to exchange goods for moola.

When it’s unsafe to send cash

Did you get wind of that postal worker who stole 6,000 greeting cards with cash, checks and gift cards? While she couldn’t cash those checks, she was privy to sensitive bank account information. And instead of sending cash, which could end up in the wrong hands, only the recipient can cash in on a money order. If you don’t have a safe place (away from home) to keep your money, then paying your monthly rent and utility bills via money orders are the way to go.

You can purchase and cash a money order from:

- The U.S. Postal Service. Every U.S. post office accepts debit cards as payment for money orders. You can find a post office near you using the USPS locator.

- Money transfer outlets, which include places like Western Union or MoneyGram, as well as some convenience stores, drugstores, supermarkets and check-cashing outlets. Even some major retailers like Walmart may offer a counter where you can buy a money order.

- Banks and credit unions.

Money orders typically have a $1,000 limit. Plus, there’s a small fee. If you get one from the post office, for example, the fee is $1.20 for any amount up to $500, and $1.60 for amounts between $500 and $1,000. And, if you get a money order from CVS, there’s a 99 cent fee for a $500 limit. So, if you need more than $1,000, you’ll likely need to purchase multiple money orders.

- Fees can add up: If you’re using money orders regularly because you lack a checking account, fees will add up fast, especially if you have to make sizable payments that require multiple money orders.

- Target for scammers: Money orders are traditionally considered safe, but they can be used in fraud. In fact, the perception that they are safe is exactly what makes them perfect for scams, and they’re sometimes prohibited as a form of payment because of this risk. A money order theft may be as simple as someone intercepting the money order and attempting to put their own information over the recipient’s. Or a scammer may pay someone via a money order for more than the requested amount, then ask for the difference to be paid back. The money order turns out to be counterfeit, and the recipient is on the hook for it.

- Bank processing concerns: If you receive a money order as payment, the bank may place a hold on your account until the money order clears. This hold may last for two or three days. If you need access to money, your account is frozen.

- Not very convenient: Buying a money order requires extra steps for the purchaser. You often need to make a special trip, pay in person, and speak with someone during business hours, and pay a fee just to secure a money order. Compare that to the ease of writing a check, or using anonline banking service like Chime.

If you’ve decided a money order isn’t what you need, there are a number of options that might fit your situation better without resorting to cash. Some financial tools you can use to pay up without getting a money order include:

Cashier’s checks

Cashier’s checks are similar to money orders. They’re signed by a bank representative and drawn from a bank’s account after the funds are transferred from your own. Cashier’s checks are available for larger dollar amounts, as long as you have the necessary funds, so they’re a better choice for large payments.

Personal checks

Personal checks, while old-fashioned, are also a good alternative to money orders. Many billers and online sellers still accept personal checks, so you can use your checking account to pay bills and transfer funds. If you’ve been denied a checking account because of previous mismanagement, be sure to look intoChime’s second-chance bankingfeatures.

Wire transfers

A wire transfer is an electronic transfer of guaranteed funds and is a good alternative if you need to send money as quickly as possible. As with a cashier’s check, you’ll often need to visit your bank or a store in person. Wire transfers are more expensive(about $30 to $40in many cases) and more cumbersome, but they can’t be faked or canceled like money orders.

Electronic payments

Electronic payments of non-guaranteed funds are also an option. If you’re just paying bills, your bank’s online bill payment service can send funds almost anywhere—often for free. Online services and mobile appscan also send money at no charge.

Prepaid debit cards

How To Add Money To Chime Card

If you don’t have a bank account, consider using aprepaid debit card. These cards offer the convenience of plastic, but instead of being attached to a credit account, you load them with your own cash, typically online or at a variety of retail locations. It’s important to keep in mind that many of these cards come with a range of fees, so a traditional debit card linked to a checking account may be a better option.

When you need a more secure alternative to sending cash but can’t use a check, money orders may be your best bet. Before purchasing or cashing a money order, keep the following in mind:

- Money orders are backed up by an agency or large corporation.

- You need to provide money upfront.

- Be prepared to pay a small fee.

- Know the name of the payee and the amount you want to send.

- Fill out the fields provided.

- Keep the receipt.

Optional cookies and other technologies

We use analytics cookies to ensure you get the best experience on our website. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. To learn about how we use your data, please Read our Privacy Policy. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions.

Chime Card Deposit Cash

To learn more about how we use your data, please read our Privacy Statement.