September 7, 2016. Does the Nab have a cardless cash option from the atm, as like commonwealth bank. My daughter had lost her card and wants to get money out of her account Saturday when no branches are open? 322 Comments 1 Share. National Australia Bank. Anyone in Australia can now use a NAB branded ATM to withdraw money for free. NAB customers can use ATMs to. Customers can also use features like cardless cash where.

- Nab Cardless Cash

- What Is A Cardless Atm

- Nab Cardless Cash Flow

- Banks With Cardless Atms

- Cardless Atm Mastercard

Yes, ANZ does offer a way to withdraw cash without a card. However, the bank does not call it Cardless Cash, but Digital Wallet. Two other big banks in Australia, Commonwealth Bank, and NAB, call their equivalent service as Cardless Cash.

Why ANZ does not call it cardless cash? That’s because they do require their customers to use a card but not in a physical form but in a digital wallet (app). That’s contrary to the rest two banks that allow their customers to use just an app without a digital card to withdraw cash.

This post will explain how to use ANZ Digital Wallet and share some tips.

Requirements

To use ANZ Digital Wallet, you should meet certain criteria.

ANZ Customer

The basic condition of using ANZ Digital Wallet is you have to be an ANZ customer. You should have a bank account and an eligible card to be used in the Digital Wallet. The eligible cards can differ depending on the smart device you are using.

Smart Device

You also need to have a smart device that supports contactless payment feature. To check the eligibility of your cards by smart device, check the ANZ Card Eligibility By Smart Device table below.

Apple Pay

If you have an Apple device that supports Apple Pay, you may be able to use the Digital Wallet. In addition to the usability at ATM, you can pay in iOS apps and websites on Safari using Apple Pay. As of today, Apple Pay supports the largest range of ANZ cards.

Google Pay

Nab Cardless Cash

Do you use an Android device? If your device supports Google Pay, check the eligibility table below to see if your card can be used for the Digital Wallet. Google Pay also supports the largest range of cards.

Samsung Pay

If you have a Samsung smartphone or watch, check the eligibility table. Samsung Pay supports fewer ANZ cards for Digital Wallet.

Fitbit Pay

Fitbit is a smart device that tracks your workout, and you can use it for payment.

Garmin Pay

Garmin is also a wearable device that similar to Fitbit. You can use Garmin Pay for Digital Wallet.

ANZ Card Eligibility By Smart Device

Use this table to check your card’s eligibility for Digital Wallet. This table was created using the information from ANZ website in May 2020.

Interest Fees for Cash Withdrawal at ATM

This convenient feature is not free. According to the Digital Wallet disclaimer, it will incur interest and you may have to pay a Cash Advance Fee. The ANZ Credit Card Conditions of Use document explains the definition of cash advance.

A cash advance refers to cash withdrawal from an ATM selecting “credit” as the account type. This will always charge interest even though you are in the interest free periods on your credit card account. The interest will generally be charged from the cash advance date until you pay off that amount in full. During that period, interest will keep being charged.

You may prevent from being charged interest if your credit card account is in credit (by at least the amount of the cash advance) upon the cash advance.

How to Use Digital Wallet at ATM

Using the Digital Wallet at an ANZ ATM is straightforward.

- Open your digital wallet app and choose your ANZ card.

- Tap your smart device at the contactless symbol that looks like below.

- Enter your PIN.

With these steps, you can withdraw cash without a physical card from your wallet. You can use your Digital Wallet at any ANZ ATM across Australia.

Once you completed withdrawal from an ATM, you may receive notifications for your transaction if you have turned on notification for your Digital Wallet.

Conclusion

Although ANZ does not have “cardless cash”, the bank provides the digital wallet feature. While cardless cash is only for cash withdrawal at ATM, ANZ’s digital wallet can be used to pay at an online or offline store. Check the requirements and note that it can incur fees. With these in mind, you are now ready to use Digital Wallet.

If you want to learn more about cardless cash,

Cardless cash has been around us in Australia for many years. Thanks to the convenience, the growing number of people shows interest in the service as you will find in this post. This post will provide information about cardless cash to the readers. As you read the articles, you will also learn what benefits you can gain by using it.

What is cardless cash?

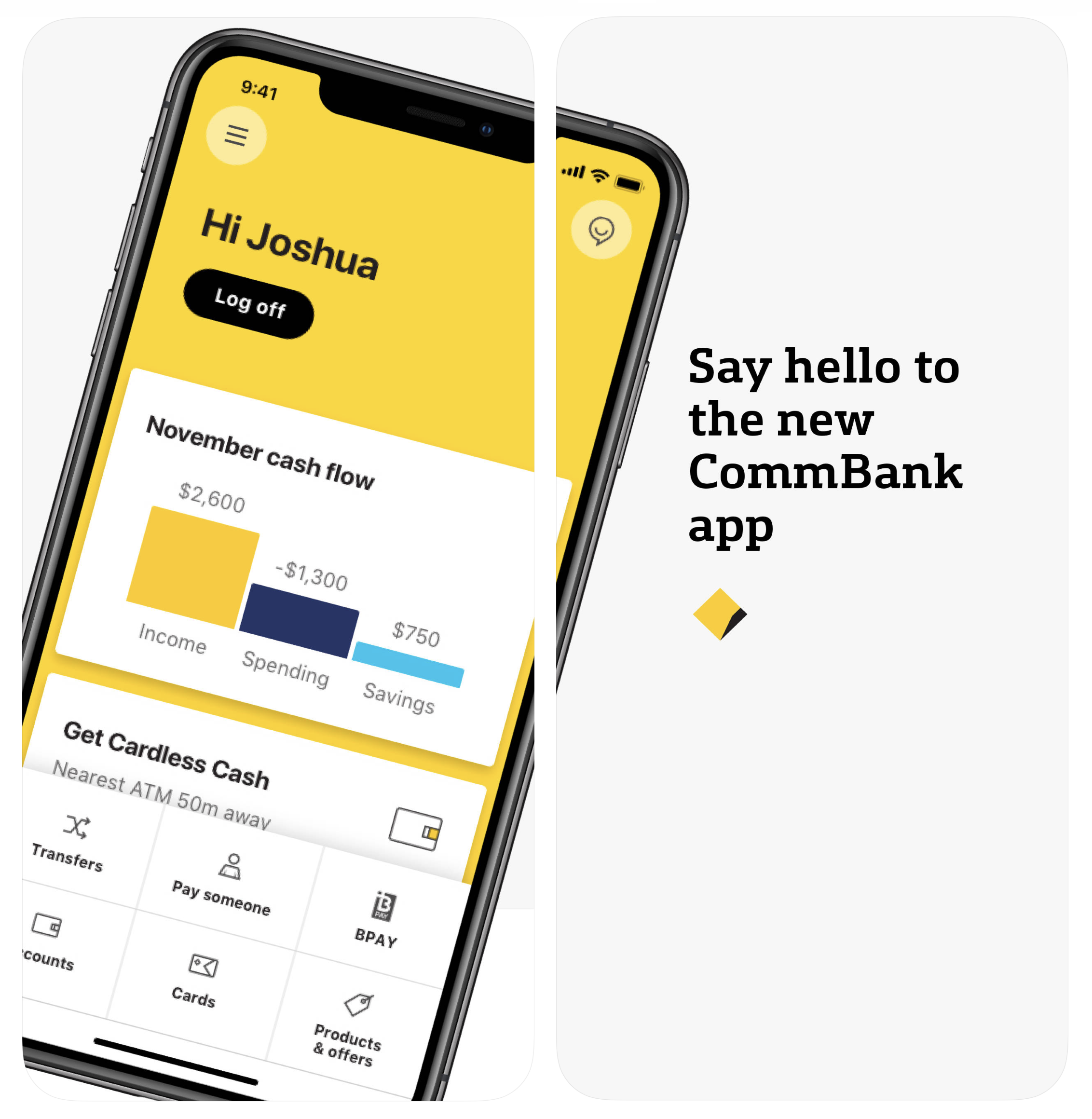

Traditionally you had to use a card to withdraw cash out of ATM. In this digital age where many things are becoming digital, your credit and debit cards are also becoming obsolete. People now use their smartphone or smartwatch to pay at a store. Why not using a smartphone to withdraw cash? That is the main idea of cardless cash. The banks offering the service allow their customers to cash out of the bank’s ATMs without a card. All you need is your smartphone with the bank’s app installed.

What banks do cardless cash?

The cardless cash service is available in Australia. Not all Australian banks have the service. Instead, only several banks do cardless cash. According to Finder, there are 5 banks that offer the convenient feature.

- Westpac

- CBA (Commonwealth Bank)

- St. George

- Bank SA

- Bank of Melbourne

What Is A Cardless Atm

Does ANZ have cardless cash?

I found that many people are asking if ANZ offers cardless cash. Not exactly although they have a quite similar service, digital wallet. It does not have the same features as cardless cash has, but still, you can withdraw cash without a physical card.

How does cardless cash work?

Although there are slight differences among those banks, the way it works is very similar. First of all, you should be a customer of one of the banks with a transaction account. Then, you will need to install the bank’s app (always free) on your smartphone. When you are able to access your bank account via the app, then you are pretty much ready to use the bank’s cardless cash.

Generally, you will have to fill out a small form asking how much cash you want to withdraw and if it’s you or someone else arriving at the ATM. Importantly, you will put your phone number or someone else’s phone number to receive a secret code. You will enter this code in the ATM. Due to security, the code will get expired after a certain period – usually after 30 minutes or up to 3 hours depending on the bank.

You might be wondering, “wait, someone else can withdraw my cash?”. Yes, you read it correctly. Let’s say that your partner forgot carrying a card or a wallet while outside but needing cash for an urgent reason. You can help your partner by allowing him or her to withdraw your cash using the ATM. That person simply will need to receive a secret code from you and enter the number. As a protection measure, all of the banks have a limit on the maximum withdrawal amount and frequency.

Cardless cash access

To clarify, only the person having access to your bank account and mobile app has cardless cash access. As explained above, you can start and manage cardless cash using your bank’s mobile app. When you select the amount for withdrawal, exactly the same amount will be debited from your linked transaction account.

Cardless ATM cash access

Accessing your cash through ATM required the secret code that will only be sent to the person (you or someone else) that you authorise. With the secret code, you or the person can withdraw cash as much as you selected on the bank’s app. After a certain time, the secret code will be expired and you or the person cannot use it anymore. If that happens, you can retry it, then the bank will send a new secret code.

Cardless cash app

I mentioned that you must use a mobile app to use cardless cash. The Finder article explained that all of the five banks have a free Andriod App and iOS APP. For iOS, your device should have iOS 10.0 or later. For Android, you should have a version of 6.0 or above. The iOS app is also compatible with iPad and iPod touch.

Trend

Is cardless cash something trendy these days? Are other people also interested in using it? If the service is reliable and convenient making people’s life easier, more and more people will show an interest in it. How can we measure the level of interest?

Google Trend

I used Google Trend to check how frequently “cardless cash” is searched on Google over the past 5 years. Google Trend is a useful tool to measure the interest of people. The more frequently people search on Google, the more popular or trendy it is. The Google Trend (may not visible on a mobile phone) of the firm below shows that people have consistently shown an interest in the service over that period although there were fluctuations.

Note that this is the trend in Australia. Google Trend provides breakdowns by the state as below.

The biggest interest came from Western Australia followed by Queensland, New South Wales, Victoria, and South Australia. When I reviewed other products and services for my blog, the state gap was not this close, which means people in all the major Australian states searched about cardless cash quite evenly.

Fraud

Even though cardless cash has all those positive features, will it be perfectly safe? As I researched the service, I found a few fraud cases.

SMS Phishing

This Yahoo Finance news article introduces a fraud case using an SMS message. This case happened to Commonwealth Bank’s customers. The text message allured the customers to check the CBA’s cardless cash feature by fakely offering $500. The article shared the actual message that goes, “NetBank Alert: Help us to test the CommBank app and get a $500 bonus”. Then, it showed a link to a fake CBA website with a more detailed message.

The message makes you create a $500 Cash Code which will require your access to your account. The article didn’t share more details, but basically, your $500 cash will go into those wrong hands.

Purchase

This article introduces another type of cardless cash fraud. It says that there were a number of cases where cardless cash was used for the scam. It happened when the service customers tried to purchase tickets from someone else not via a proper website or payment service. Remember that you should use cardless cash only for cash withdrawal for yourself or someone close to you like family members.

The case went like this. The scammer asked for the cardless cash code to withdraw the ticket price from an ATM. Then the scammer, after withdrawing the cash, disappeared. In this case, the victim couldn’t be protected because cardless cash is not a platform where you can safely trade your money for an item. So, don’t use it to buy things.

So, is it safe?

Yes, although there were some fraud cases, I think this type of scam happens in any other digital products and platforms. You will even receive SMS scams or Phishing calls from unknown persons. The banks will never ask you for the cash code or your password. If you are suspicious of SMS messages asking for your personal information, I think you can just basically ignore it and delete the message.

Differences from Digital Wallets

As mentioned above, NAB and ANZ don’t have cardless cash. Instead, they and other major banks, have this digital service called digital wallet.

What is Digital Wallet?

Digital wallet refers to an electronic device or online service that enables individuals to make electronic transactions according to Wikipedia. The explanation may not be easy to understand. In everyday life, people use a digital wallet with their smartphone. Please note that only recent smartphones support digital wallet since a device should have an NFC chip in it. NFC, or Near Field Communication, allows wireless communication with a merchant terminal (like the card reader).

So, it is like you are carrying a credit or debit card inside your smart devices such as smartphone, smartwatch, and tablet PC. You can pay simply by holding your smart device near a terminal. To use this, please check availability with your bank.

Differences

The biggest difference is that you cannot (and shouldn’t) use cardless cash at a store or on an online platform to buy items. It is designed only for cash withdrawal. Instead, with your digital wallet, you not only can buy items but also withdraw cash from the bank ATM. You might think that you should then just use the digital wallet instead of cardless cash. Not too soon.

The Finder’s Pros vs Cons comparison points out that digital wallet is still a new technology that you cannot expect all merchant would support the payment method. We will have to wait until many more consumers start using this technology. But, considering only recent devices (that are usually expensive) are compatible with the smart wallet, it would take a while.

Conclusion

Nab Cardless Cash Flow

Cardless cash provides the convenience of not having to carry your wallet or allowing someone else to withdraw cash from ATM. This smart feature is free of charge, so there is no harm to try the service. Please make sure that your bank supports cardless cash. And, lastly, remember not to share any of your personal information with your bank.

Banks With Cardless Atms

Useful Links

Cardless Atm Mastercard

I reviewed cardless cash features of Commonwealth Bank and Westpac on my blog. Please check: